| Market: Milan | Symbol: AZM | ISIN: IT0003261697 | Industry: Financial Services |

Corporate Profile

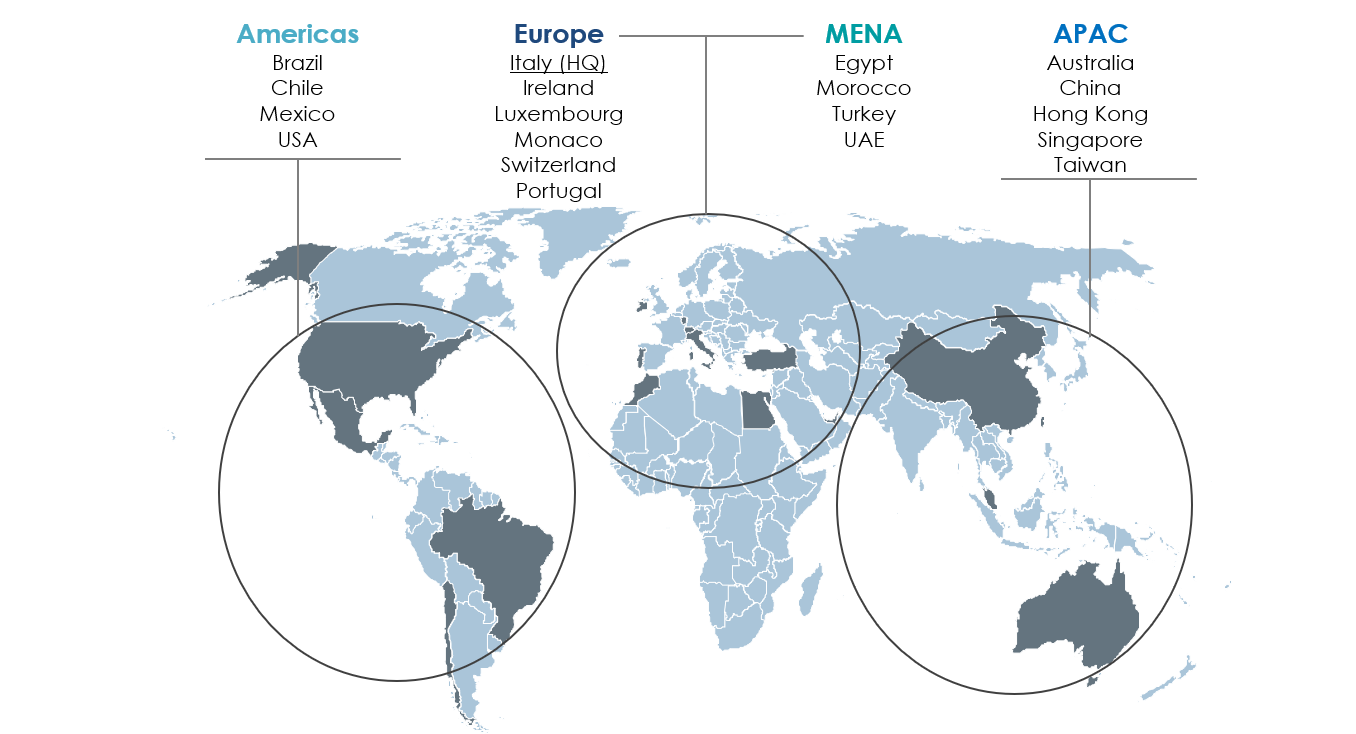

Azimut is an independent, global group specializing in asset management across public and private markets, wealth management, investment banking, and fintech, serving private and corporate clients. Listed on the Milan Stock Exchange (AZM.IM), the Group is a leading player in Italy and operates in 19 countries worldwide, with a focus on emerging markets. The shareholder structure includes approximately 2,000 managers, employees, and financial advisors bound by a shareholders’ agreement that controls around 22% of the company, while the remaining shares are in free float. The Group comprises a network of companies active in the management, distribution, and promotion of financial and insurance products, with registered offices in Italy, Australia, Brazil, Chile, China and Hong Kong, Egypt, Ireland, Luxembourg, Morocco, Mexico, Monaco, Portugal, Singapore, Switzerland, Taiwan, Turkey, and the United States.

Share Data

| Currency: | EUR |

| Previous Close | 26.08 |

| Number of Shares | 143,254,497 |

| Market Cap | 3,736,077,282 |

Income Statement: |

||

|---|---|---|

| €/000 | FY 2024 |

FY 2023 |

| Entry commission income |

13,975 |

12,162 |

| Recurring fees | 1,216,772 |

1,138,307 |

| Variable fees |

47,618 |

18,208 |

| Other income | 29,888 |

32,358 |

| Insurance revenues | 161,352 |

110,981 |

| Total Revenues | 1,469,604 |

1,312,016 |

| Distribution costs | (432,400) |

(388,954) |

| Personnel and SG&A |

(346,714) |

(310,196) |

| Depreciation, amort./provisions |

(37,304) |

(25,470) |

| Operating costs |

(816,419) |

(724,620) |

| Operating Profit |

653,185 |

587,396 |

| Finance income | 195,329 |

60,865 |

| Net non-operating income/(costs) | (18,151) |

(14,565) |

| Finance expense | (8,192) |

(8,633) |

| Profit Before Taxation | 822,171 |

625,065 |

| Income taxation | (208,655) |

(160,954) |

| Deferred taxation |

(9,032) |

(6,096) |

| Net Profit | 604,484 |

458,013 |

| Minorities | 28,319 |

23,446 |

| Consolidated Net Profit | 576,165 |

434,567 |

| Adjusted Net Profit | 587,907 |

453,988 |

| €/000 | 31/12/2024 |

31/12/2023 |

31/12/2022 |

| Bank loan | (154) |

(222) |

(288) |

| Securities issued | 0 |

(496,982) |

(497,916) |

| Total debt | (154) |

(497,204) |

(498,204) |

| Cash and cash equivalents | 749,660 |

889,416 |

791,262 |

| Net Financial Position | 749,506 |

392,212 |

293,058 |

Earnings per share: |

||

|---|---|---|

| € | 2024 |

2023 |

| Basic earnings per share | 4.10 |

3.14 |

| Average number of outstanding shares (*) | 140,499,388 |

138,402,704 |

Note:

* Outstanding shares are calculated net of treasury shares held by Azimut Holding S.p.A. at the reporting date.