|

|

| Market: DFM |

Symbol: TABREED |

ISIN: AEN000501017 |

Industry: Services |

|

Ever since Tabreed was commissioned by the UAE Government to construct a district cooling plant in Suweihan in the late 1990s, the company has continued to play a vital role in enabling the nation’s economic development by providing pioneering cooling solutions to key infrastructure projects - first in the UAE, and later, across the GCC.

In the UAE, during the peak summer months, air-conditioning typically accounts for 70% of energy consumption. By utilizing approximately 50% less energy, district cooling helps reduce costs to owners and governments alike, while also protecting the environment by decreasing carbon dioxide emissions.

Today, Tabreed delivers its energy-efficient, economical, and environmentally-friendlier cooling solutions to many of the region’s landmark projects, including the Sheikh Zayed Grand Mosque, Burj Khalifa, The Dubai Mall, Dubai Opera, The Dubai Fountain, Cleveland Clinic, Ferrari World, Yas Mall, Aldar HQ, Etihad Towers, Marina Mall, World Trade Center in Abu Dhabi featuring the Burj Mohammed Bin Rashid, Dubai Metro, Dubai Parks & Resorts, and the Jabal Omar Development in the Holy City of Mecca, to name just a few.

Its services have reduced energy consumption in the GCC by more than 2.64 billion kilowatt hours in last twelve months, which has led to the elimination of over 1.58 million tons of carbon dioxide emissions from our atmosphere – the equivalent of removing over 343,000 cars from our streets every year.

With 27 years of successful regional experience, Tabreed has pioneered district cooling in the UAE and across the GCC, partnering on milestone projects that have been at the heart of infrastructure development and have set the standard for the industry. Its portfolio now includes 92 plants in the GCC that deliver over 1.325 million refrigerated tons to projects vital to their respective nations’ economic development and diversification.

|

|

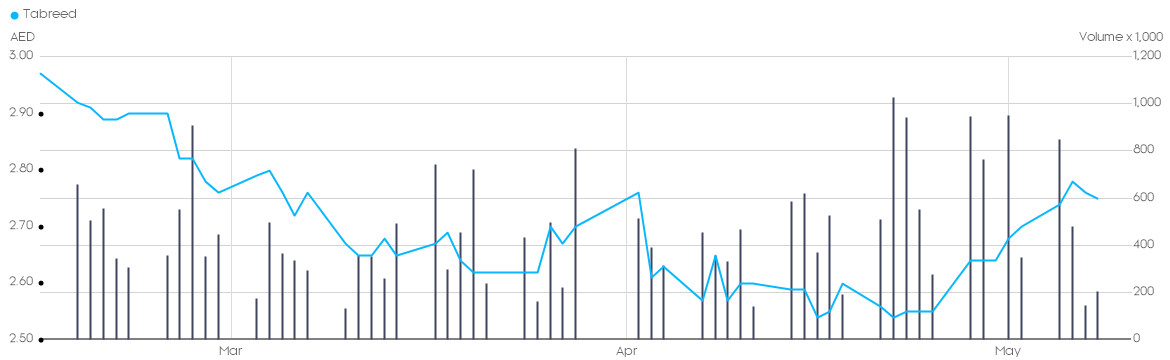

| Currency |

AED |

| Previous Close |

2.70 |

| Change (%) |

1.12 |

| Volume |

810,911 |

| Number of Shares (mln) |

2,845.3 |

| Market Cap (mln) |

7,682.2 |

|

|

|

|

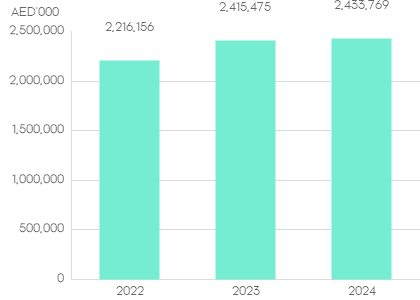

Revenue

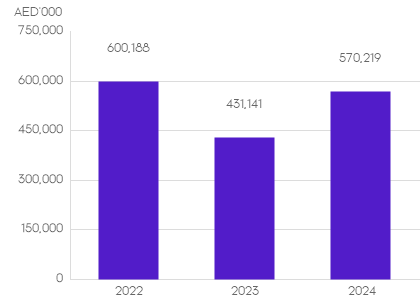

Profit for the year attributable to

Ordinary equity holders of the parent

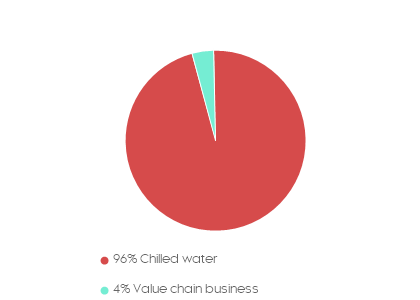

Revenue by operating segments 2023

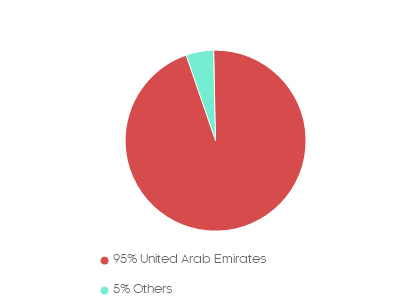

Revenue by geographic segments 2023

|