| Market: Tadawul | Symbol: 1180 | ISIN: SA13L050IE10 | Industry: Bank |

The Saudi National Bank (SNB) is the largest financial institution in Saudi Arabia and one of the largest powerhouses in the region. SNB plays a vital role in supporting economic transformation in Saudi Arabia by transforming the local banking sector and catalyzing the delivery of Saudi Arabia’s Vision 2030. Its strategy is closely aligned with the Vision’s programs. SNB also leverages its position as the largest institutional and specialized financier in the Kingdom to support the Kingdom’s landmark deals and mega projects.

SNB’s vision is to be a premier financial and banking service provider locally and regionally through the fulfilment of strategic aspirations: to be number one in revenues, number one in profit, the best in customer service, the best digital bank, and the employer of choice, and the best Shariah-compliant products service provider in the world. The Bank’s effort to achieve these aspirations is reflected in achieving record annual profits for the eighth consecutive year.

SNB seeks to leverage the expanded scale, reach, and digital capabilities to provide enhanced products and deliver unparalleled customer experience. SNB robust balance sheet, resilient business model, and healthy liquidity position enhance the Bank’s capability to compete locally and regionally, and to facilitate trade and capital flows between the Kingdom and regional and global markets.

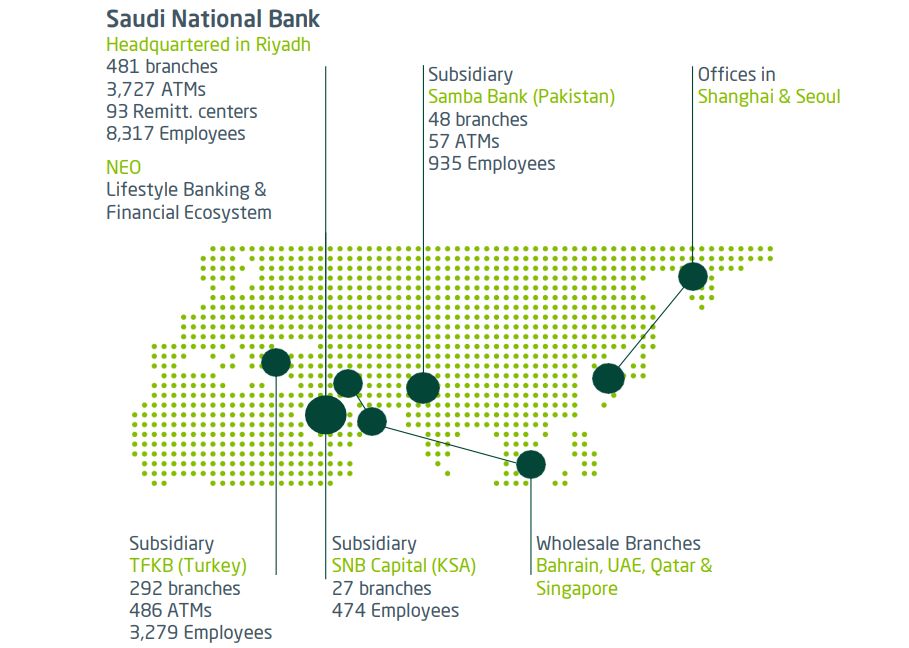

SNB delivers best-in-class digital solutions, drive homeownership through growth in residential finance, foster MSME development and lending, and seeks to be the foremost trusted partner for top-tier Saudi corporates and institutions to support the Kingdom’s mega deals and projects, and to be the biggest provider of Shariah-compliant products for all segments. The Saudi National Bank is a leader in treasury and capital markets, and it owns both NCB Capital and Samba Capital & Investment Management, who, together would form the biggest asset manager, brokerage and investment bank in Saudi Arabia. SNB has a strong international presence in Middle East, South Asia and Turkey, which supports the Bank’s vision to compete regionally and internationally to earn our place as a global leader in financial services.

SNB is a committed supporter of Saudization, creating many opportunities for young people and achieving record rates of Saudization, its senior management team are predominantly Saudi. SNB also gives great importance to empowering women, giving them big opportunities to assume leading positions at the Bank. Corporate responsibility is an essential element of SNB corporate culture and business philosophy. Its corporate responsibility strategy focuses on empowering individuals and non-profit organizations, and supporting community activities.

Our Presence 2024

| Currency | |

| Last Closing Price | 34.70 |

| Change (%) | 0.43 |

| Volume | 9,045,276 |

| Number of Shares (mln) | 6,000 |

| Market Cap (mln) | 208,200 |

| FINANCIAL HIGHLIGHTS (SAR '000) | 2022 | 2023 | 2024 |

|---|---|---|---|

| Income statement | |||

| Net special commission income | 26,287,199 | 27,008,940 | 27,730,190 |

| Total operating income | 33,004,553 | 34,589,401 | 36,038,363 |

| Total operating expenses | 11,470,202 | 11,279,831 | 12,060,984 |

| Net income for the year | 18,728,837 | 20,108,827 | 21,093,646 |

| Basic earnings per share (SAR) | 3.03 | 3.23 | 3.44 |

| Diluted earnings per share (SAR) | 3.02 | 3.23 | 3.43 |

| Balance sheet | |||

| Investments, net | 258,291,891 | 269,128,954 | 292,486,807 |

| Financing and advances, net | 545,310,659 | 601,527,454 | 654,252,346 |

| Customers’ deposits | 568,283,076 | 590,051,062 | 579,762,107 |

| Total assets | 945,496,166 | 1,037,081,167 | 1,104,154,640 |

| Total liabilities | 778,718,535 | 860,452,454 | 910,879,379 |

| Total equity | 166,777,631 | 176,628,713 | 193,275,261 |

| Key performance indicators (KPIs) (%) | |||

| Cost to income ratio | 27.1 | 27.6 | 28.3 |

| Cost of risk | 0.33 | 0.16 | 0.16 |

| CET1 ratio | 16.1 | 17.3 | 17.6 |

| T1 ratio | 18.3 | 19.4 | 20.3 |

| Total capital ratio | 19.0 | 20.1 | 20.8 |

| Liquidity coverage ratio (LCR) | 277.6 | 258.1 | 265.2 |